Table of Contents

- S&P 500 Performance Q3 2025 - Linda S. White

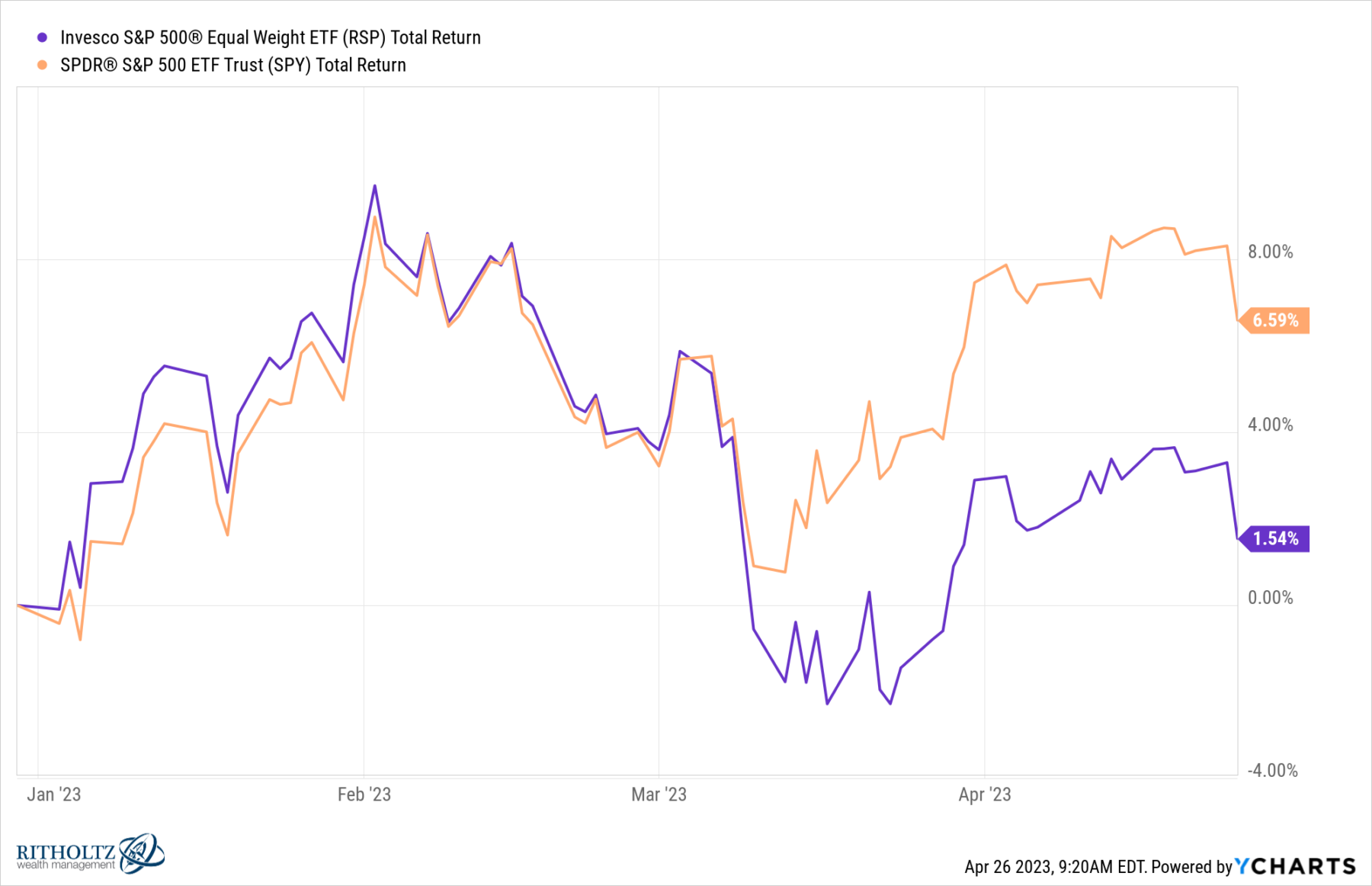

- What Does the Relative Performance of Equal Weight S&P500 Mean? | Viral ...

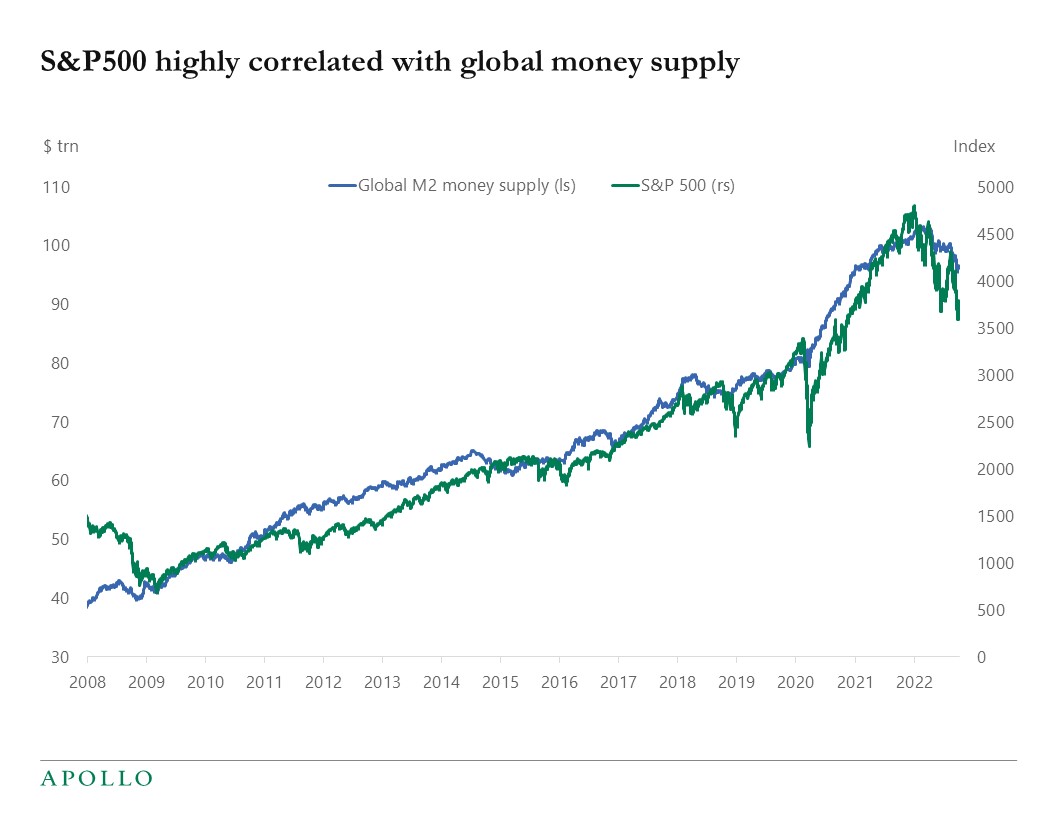

- SP500 vs M2 for SP:SPX by CapnBigPain — TradingView

- Gold Vs. S&P 500: Which Has Grown More Over Five Years? | ZeroHedge

- S&P 500 | Indeks Yang Perlu Anda Tahu – Superscalper

- POGNON] Topic Bourse : TRUMP = PUMP ? ╤╤╝ - Page : 18058 - Loisirs ...

- S&P 500 renueva su máximo histórico, otra vez

- Why is S&P 500 used as a benchmark for market performance so often?

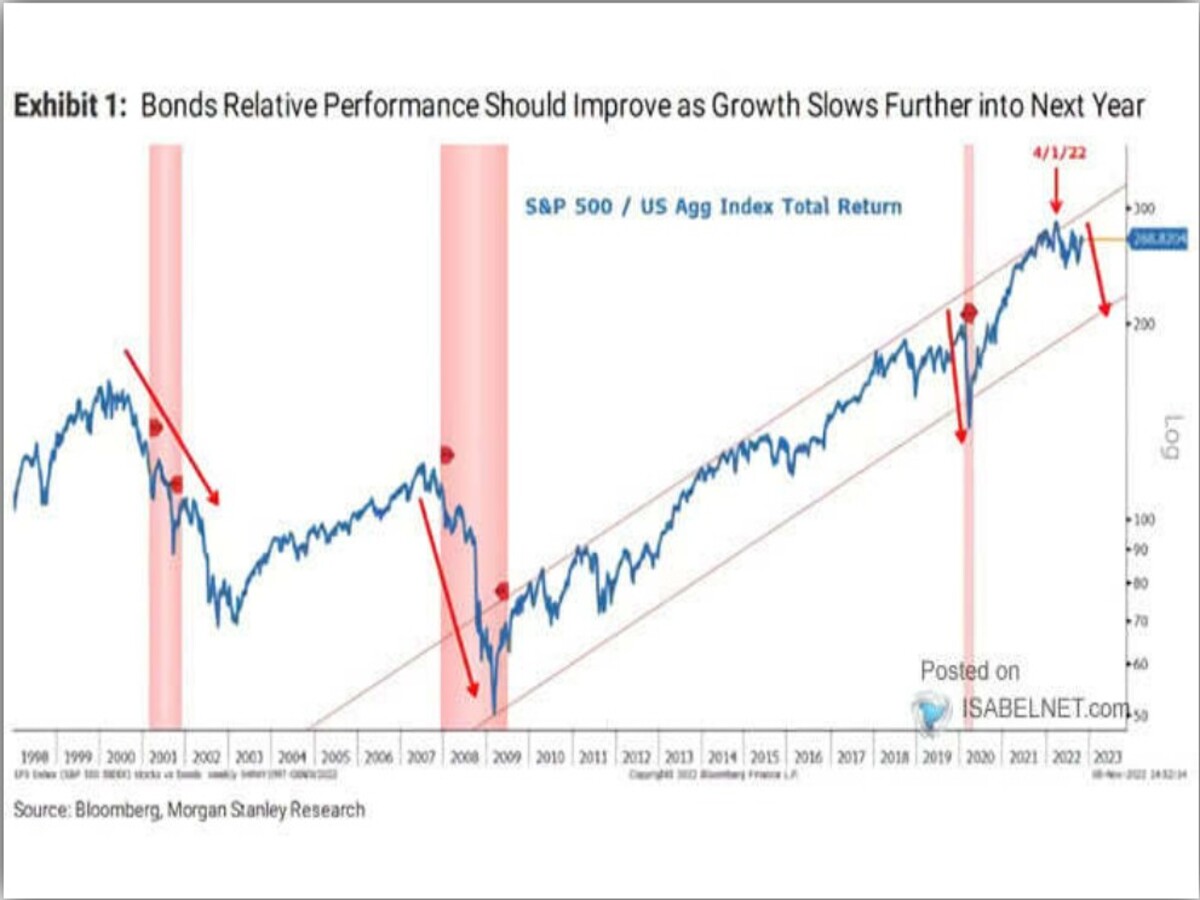

- Evolución SP500 / U.S Aggregate Bond Index Total Return - Vulcano ...

- S&P500 vs. M2 - Apollo Academy

![POGNON] Topic Bourse : TRUMP = PUMP ? ╤╤╝ - Page : 18058 - Loisirs ...](https://www.personalfinanceclub.com/wp-content/uploads/2023/02/2023-02-07-SP500-Every-Year.png)

A Brief History of the S&P 500 Index

Composition of the S&P 500 Index

Significance of the S&P 500 Index

The S&P 500 Index is widely regarded as a benchmark for the overall performance of the US stock market. It is used by investors, financial analysts, and economists to gauge the health of the economy and to make informed investment decisions. The index is also used as a basis for a wide range of financial products, including index funds, exchange-traded funds (ETFs), and options contracts.

Using the S&P 500 Index as an Investment Tool

The S&P 500 Index can be used as a tool for investors in a variety of ways. One of the most popular ways to invest in the S&P 500 is through index funds or ETFs, which track the performance of the index. These funds provide investors with a diversified portfolio of stocks, allowing them to benefit from the performance of the overall market. Additionally, the S&P 500 Index can be used as a benchmark for actively managed funds, allowing investors to compare the performance of their investments to the overall market. In conclusion, the S&P 500 Index is a powerful tool for investors and financial professionals. Its rich history, diverse composition, and widespread use make it an essential benchmark for the US stock market. By understanding the S&P 500 Index and how it works, investors can make more informed decisions and gain a deeper understanding of the overall health of the economy. Whether you are a seasoned investor or just starting out, the S&P 500 Index is an important resource that can help you achieve your financial goals.Keyword: S&P 500 Index, stock market, investment, finance, economy